Gift & Estate Tax Myths: Debunked

By Sidhartha, Philosopher, Lawyer, and Truth-Seeker

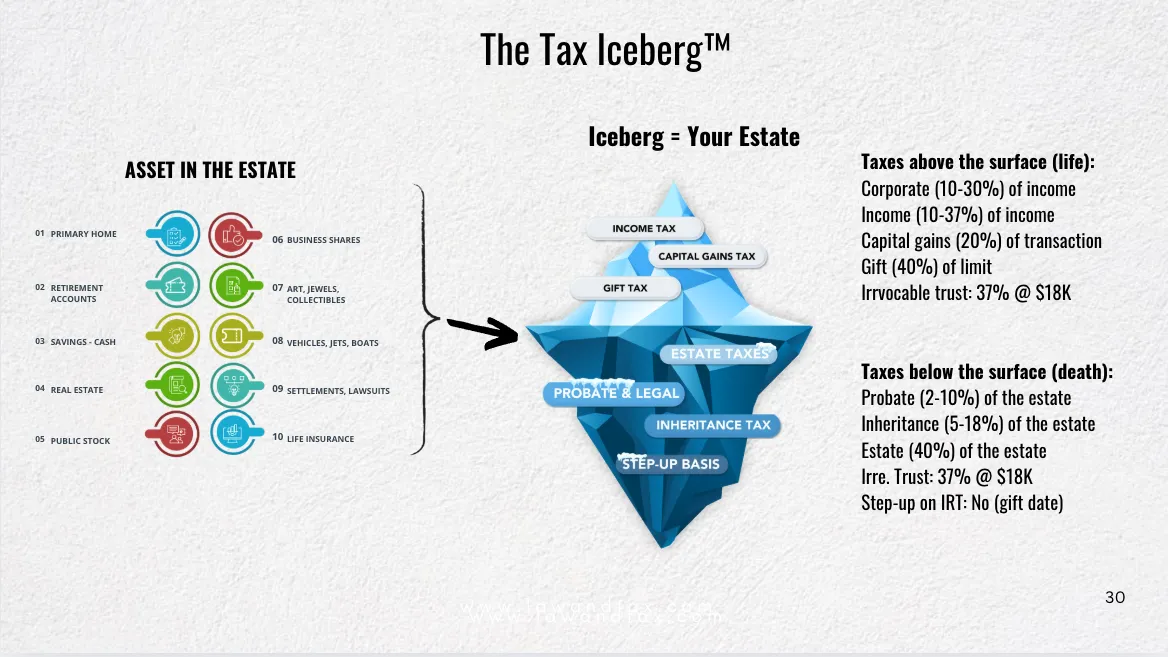

Abstract: High-net-worth (HNW) individuals, entrepreneurs, and C-suite executives often believe estate and gift taxes can be easily avoided or eliminated through simple strategies like unlimited gifting or trusts. This myth jeopardizes wealth preservation, risking losses up to 53% from federal (40%), state inheritance (5–18%), and probate (3–10%) taxes. Drawing on 25 years of experience, this white paper, updated at 06:10 AM CDT, June 29, 2025, debunks these misconceptions using the BENT Law™ Framework and the Tax Iceberg™ Concept—a tool I’ve developed to reveal hidden tax burdens. It explores worst-case scenarios, cites real-world cases, and offers a strategic path via a BENT Law™ Estate and Tax Assessment to protect estates, especially those over $2 million.

Introduction: The Misconception of Tax-Free Wealth Transfer

As a high-net-worth individual, investor, or C-suite leader, you’ve built a legacy through foresight and effort. Yet, a pervasive myth suggests estate and gift taxes can be sidestepped with ease—unlimited gifting, a quick trust, or basic planning. Twenty-five years ago, I fell for this illusion, losing a significant portion of my estate to taxes due to poor coordination. Since then, I’ve sought truth, developing the Tax Iceberg™ Concept to expose these risks and guide others.

Estate and gift taxes, rooted in 1797 and formalized in 1916 to address wealth inequality and public funding, are governed by the Internal Revenue Code (IRC). This white paper blends philosophical insight with strategic analysis, using the Tax Iceberg™ to reveal the hidden layers of tax liability and advocate for proactive planning.

The Myth: Estate and Gift Taxes Are Easily Avoided or Eliminated

Issue: Can Estate and Gift Taxes Be Sidestepped Without Strategy?

Entrepreneurs and investors often assume estate and gift taxes can be bypassed with unlimited gifting, trusts, or ad-hoc planning. But does this hold under scrutiny, especially for estates over $2 million?

The Tax Iceberg™ Concept: Unveiling the Hidden Layers of Your Estate

Your estate is like an iceberg: Only a portion is visible above the surface, while the majority lies hidden below, posing unseen risks.

All assets you control and own are in your berg: This includes investments, real estate, business interests, and insurance policies, forming the total taxable base.

Taxes are due while alive and at death: They impact your wealth across both stages of life.

Alive - more obvious - most experts offer solutions here: Income and capital gains taxes are visible and often addressed by advisors with straightforward strategies.

Death - more complex - more strategic, can't change so planning now is needed: Estate, gift, inheritance, and probate taxes emerge, requiring proactive planning since adjustments are impossible post-mortem.

As you defer tax above, it shifts below - doesn't go away: Delaying income or capital gains taxes increases the estate’s taxable value at death, transferring the burden downward.

People fail to see or consider the below - all the myths lead to this hidden layer of surprises: Misconceptions about gifting or trusts blind individuals to submerged tax risks.

Most lawsuits with high-net-worth (especially asset-rich) estates revolve around this concept: Disputes over tax inclusion or probate (e.g., Estate of McNeely v. Commissioner, T.C. Memo 1994-376) stem from ignoring the iceberg’s bottom.

The Mini Family Office Model is the solution - ongoing strategic and tactical decision-making: This approach unifies strategies, with quarterly reviews to manage the iceberg dynamically.

As you move or defer up, it sinks to the bottom and is due at death: Shifting assets or deferring taxes without coordination increases the death tax burden.

Wills and trusts don’t automatically beat probate: Proper funding and alignment are critical, as errors can still lead to court involvement.

Results from the survey with probate lawyers (300+ responses, Sid Peddinti, X poll, June 28, 2025) show a ton of reasons why things end in probate: Summarized as 19% unfunded trusts, 13% defective self-prepared plans, 15% family misunderstanding of benefits, 2–3% capacity or term challenges, 1% beneficiary disputes, and 1% sibling rivalry.

So small mistakes and oversights can be devastating - and it’s the kids who face the results, not you: A $66,000 probate fee on a $2 million estate or a $1.066 million total tax hit (53%) burdens heirs.

Each advisor operates in silos, no one is calculating or keeping track of overall changes and how the shift is happening: Without a unified playbook, tax deferrals and asset movements go unmonitored.

You can only reduce the bottom by gifting, donating, or selling it off - so that’s where the playing of identities and understanding how to shift identities to capture the full power of the code, taxable entities, and tax-exempt entities comes into play: Strategic use of IRC provisions (e.g., §2503, §2056) and entity structuring minimizes the death tax load.

History and Rationale: Why Estate and Gift Taxes Demand Strategy

The U.S. estate and gift tax system began with a 1797 stamp tax for the Quasi-War with France, evolving into the 1916 estate tax and 1924 gift tax (refined in 1932) to finance World War I and curb wealth concentration. Aimed at reducing inequality, funding public goods, and preventing evasion, these taxes set a 2025 exemption at $13.61 million (IRC §2001) and an annual gift exclusion of $18,000 (IRC §2503). However, the old $7 million limit (pre-2018 TCJA) remains a contingency planning benchmark, as future policy shifts could expose estates over $2 million to up to 40% federal tax, 5–18% state inheritance, and 3–10% probate costs.

Common Triggers and Scrutinized Assets

Taxes are triggered by gifts over $18,000 (IRC §2503), estates exceeding $13.61 million (or $7 million if limits revert), or retained control (IRC §2036), with audits flagging late filings (IRC §6501, 3-year lookback). Scrutinized assets include:

Investment Portfolios: A $1 million stock portfolio taxed at death (e.g., a 2020 case where mismanagement cost $400,000 [40% of $1 million]).

Business Interests: A $2 million company stake (e.g., Estate of Watts v. Commissioner, T.C. Memo 2014-118, adding $800,000 [40% of $2 million]).

Retirement Accounts: A $500,000 IRA included due to poor structuring (e.g., a 2019 audit costing $200,000 [40% of $500,000]).

Impact: For a $2 million estate (e.g., $1 million home, $1 million stocks/real estate), a 40% federal tax ($800,000 [40% of $2 million]) plus $66,000 probate [4% of $100,000 = $4,000; 3% of $100,000 = $3,000; 2% of $800,000 = $16,000; 1% of $900,000 = $9,000; executor and attorney fees at $32,000 each = $64,000, rounded to $66,000] and 10% California inheritance tax ($200,000 [10% of $2 million]) totals $1.066 million (53% of $2 million).

Rule: The Legal and Strategic Framework

Defined by IRC §2001, §2503, §2036, and case law (e.g., United States v. O’Malley, 383 U.S. 627, 1966), these taxes require integrated oversight.

Analysis: Debunking the Key Misconceptions

Myth 1: Unlimited Gifting Avoids Taxes

Truth: Excess over $18,000 reduces the exemption (Estate of Smith v. Commissioner, 198 B.R. 602, 1996, where $1.5 million in gifts triggered tax).

Implication: Unstructured gifting shifts tax to the iceberg’s bottom.

Myth 2: Estates Can Be Tax-Free with Proper Planning

Truth: Retained control keeps assets taxable (IRC §2036; O’Malley, 1966, upheld $1 million tax on a trust).

Implication: Simple plans fail to address death taxes.

Myth 3: Trusts Eliminate Estate and Gift Taxes

Truth: Revocable trusts are taxable; irrevocable ones need proper structure (Estate of Maxwell v. Commissioner, 3 F.3d 591, 1993, failed to avoid $1.2 million tax).

Implication: Misalignment sinks assets to the taxable bottom.

Myth 4: Spousal Transfers Are Always Tax-Free

Truth: Non-citizen spouses require QDOTs (IRC §2056; a 2015 case added $300,000 tax).

Implication: Cross-border planning is critical.

Conclusion: Strategy Beats Myths

The myth that estate and gift taxes can be easily avoided overlooks the Tax Iceberg™’s hidden layers, exposing $2 million estates to $1.066 million in taxes without coordinated planning.

BENT Law™ Framework: A Strategic Lens for Tax Optimization

The BENT Law™ Framework—Behavior, Entity, Numbers, Timing—evaluates risks and aligns strategies.

B – Behavior

Aggressive gifting without tracking invites scrutiny (Smith).

E – Entity

Misaligned trusts fail (IRC §2036).

N – Numbers

Estates over $7 million face 40%+ taxes.

T – Timing

Late planning risks audits (IRC §6501).

BENT Risk Lens Summary:

Category

Risk for HNW Clients

Behavior

Untracked moves → scrutiny

Entity

Misaligned trusts → taxable

Numbers

Large estates → 40%+ hit

Timing

Late action → audits

The Strategic Blind Spot: Worst-Case Scenarios

Above the Surface: “I can avoid taxes with gifting or trusts.”

Below the Surface:

$18,000 exclusion; excess cuts $7 million exemption if limits revert.

Control (IRC §2036) keeps assets taxable.

Trusts need irrevocable status and funding.

Audits target delays (IRC §6501).

A $2 million estate faces $1.066 million tax ($800,000 federal [40%], $66,000 probate, $200,000 inheritance [10%]).

Cases (Watts, McNeely) show million-dollar losses.

Strategic Insight: Working backward from a $7 million limit, uncoordinated planning sinks wealth to the Tax Iceberg™’s bottom.

Maximizing Value: Strategic Steps to Protect Your Wealth

Consider these steps:

Cap Gifting: Stick to $18,000, track with coordination.

Use Irrevocable Trusts: Align with tax plans, avoiding IRC §2036 pitfalls.

Leverage Exemptions: Plan for $7 million contingency (IRC §2056).

Stress-Test Your Plan: Apply BENT Law™.

Understand Choices: Explore gifting, trusts, or bequests holistically.

Adopt the Mini Family Office Model: Unify strategies, hold quarterly reviews.

Engage Experts: Ensure collaboration to reduce the iceberg’s bottom.

Call-to-Action: Secure Your Legacy with a BENT Law™ Estate and Tax Assessment

Don’t let myths erode your wealth. My BENT Law™ Estate and Tax Assessment ($1,000) protects estates over $2 million:

Analysis of $7 million contingency and Tax Iceberg™ risks.

Review of trust alignment and entity structures (IRC §2036).

Strategies with case law support (O’Malley, McNeely).

Assessment using BENT Law™.

Tailored plan with Mini Family Office guidance.

Invest in your legacy. Schedule your assessment today at [insert website] or contact [insert contact info]. Protect your wealth.

SEO Optimization for HNW Audiences

Primary Keywords: “estate tax myths for high-net-worth,” “gift tax planning for $2 million estate,” “tax strategies for HNW.”

Secondary Keywords: “IRC 2036 trust risks,” “tax iceberg concept,” “estate tax exemption 2025,” “probate fees California.”

Meta Description: “Debunk estate and gift tax myths with the Tax Iceberg™ Concept. Protect a $2 million estate from 53% tax loss with a $1,000 Assessment.”

Headings: H1 (title), H2 (sections), H3 (subsections).

Internal Links: Link to “Tax Iceberg™ Guide.”

External Links: Cite IRS.gov (IRC §2001).

Search Trends: “Estate tax planning” (8K), “gift tax limits” (6K), “wealth preservation” (10K).

Conclusion: A Strategic Imperative with the Tax Iceberg™

The myth that estate and gift taxes can be easily avoided risks 53% loss for $2 million estates, especially near the $7 million limit. The Tax Iceberg™ Concept, guided by BENT Law™, reveals hidden dangers, demanding proactive planning to preserve your legacy.