Estate Planning Myth: One Size Fits All Programs And Templated Estate Plans

Estate Planning Myth: One Size Fits All Programs And Templated Estate Plans

By Sidhartha, Philosopher, Lawyer, and AI Innovator

The Trap We Fall Into: “My Estate Plan Is Set”

You’ve stacked your deck with wills, revocable trusts, irrevocable trusts, ILITs, FLPs, GRATs, and maybe even a foundation - covering your business, investments, and more. You might think, “I’m golden.” But here’s the hard truth: it’s not what you believe you have, it’s what the government sees that dictates your fate.

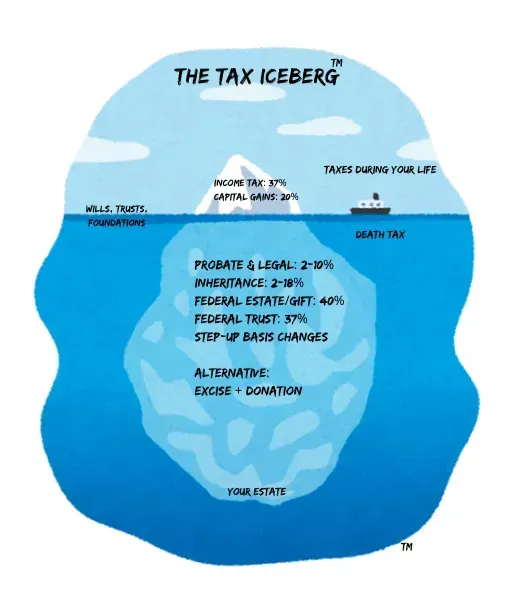

Two decades ago, I clung to that illusion, only to watch taxes erode my estate. Sound relatable? Enter Bruce Lee’s timeless advice: “Be water, my friend.” Rigid plans shatter; fluid strategies adapt. With the Tax Iceberg™ Concept as our guide, let’s rethink estate planning - not as a static fortress, but as a dynamic toolkit.

The plan? Deploy TOD for liquid assets, revocable trusts for personal holdings, irrevocable trusts for tax shields, and foundations for legacy impact - each in the right place, flowing with change.

The Philosophy of Flow: Why Adaptability Wins

Imagine a river carving through rock - persistent yet flexible. As a high-net-worth leader, entrepreneur, or executive, you’ve built a legacy worth protecting. But assuming your plan is bulletproof is like standing still while the current shifts.

The government, guided by the Internal Revenue Code (IRC), sees your estate through its own lens-2025 exemptions at $13.61 million per person (or $27.22 million for couples under §2056), with the old $7 million limit as a potential riptide. Lee’s wisdom urges us to “empty your mind, be formless” - to adapt rather than resist. This blog flows with you, showing how to wield estate tools strategically, backed by the Mini Family Office Model™ for ongoing agility.

The Myth Busted: One Plan Doesn’t Fit All

You might lean on a mix of tools, thinking they cover everything. But have you aligned them with the government’s view? Have you prepped for a $7 million exemption drop? Without flow, your strategy risks sinking. Let’s break it down - philosophically and practically - assigning each tool its rightful role.

Tool 1: Transfer on Death (TOD) for Liquid Assets

The Flow: TOD lets assets pass directly to a named beneficiary upon death, bypassing probate’s drag. Governed by IRC Section 2036 (for estate inclusion rules) and IRC Section 2001 (exemption limits), with state laws like Texas Estates Code §111.051, it’s a streamlined option.

Why does it exist? Born from 1990s reforms to simplify wealth transfer and reduce probate costs-originally spurred by administrative burdens-it empowers direct succession while keeping the government’s tax eye on the estate’s total value.

Eligible assets include bank accounts, brokerage accounts (stocks, bonds), and real estate in TOD-friendly states (e.g., Texas, Missouri). It’s quick, avoiding probate fees that can range from $5,000 to $20,000 in states like Texas (depending on estate size and complexity).

Why It Works: Easy setup with financial institutions; probate risk nears zero for covered assets.

The Catch: Limits to specific assets (no whole estate coverage); no post-transfer control (minors or incapacitated beneficiaries could stumble). Tax lingers. e.g., a $1 million TOD account faces $400,000 (40%) federal tax if the estate tops $7 million.

Best For: Cash, stocks, bonds, or TOD-eligible real estate-liquid streams needing smooth transitions.

Tool 2: Revocable Trust for Personal Assets

The Flow: Offers lifetime control (amend as needed) and skips probate if funded. Governed by state trust laws and IRC §2036 (if control issues arise), it’s about shaping your legacy with flexibility.

Why It Works: A funded $2 million trust avoids probate costs (e.g., $5,000–$20,000 in Texas or up to $200,000 in New York, depending on estate size), plus manages assets if you’re incapacitated.

The Catch: Unfunded trusts flop (19% of cases, per a June 28, 2025, X poll by Sid Peddinti); setup costs $1,000–$3,000. Mismanagement (e.g., Estate of Maxwell v. Commissioner, 1993, $1.2 million tax hit) risks IRC §2036 inclusion if control lingers.

Best For: Homes, personal property - assets you want to shape and pass seamlessly.

Tool 3: Irrevocable Trust for Tax Shields

The Flow: Once set, it’s locked - removing assets from your taxable estate under IRC §2036 if properly structured. It’s a deliberate current, shielding wealth from estate taxes while supporting beneficiaries or causes.

Why It Works: A $2 million irrevocable trust can exclude that amount, avoiding $800,000 (40%) federal tax if near $7 million, plus probate savings.

The Catch: Loss of control; setup and maintenance cost $2,000–$5,000. Errors (e.g., United States v. O’Malley, 1966, upheld $1 million tax) can pull assets back if control persists.

Best For: Large investments, business interests - assets needing tax protection.

Tool 4: Foundation for Legacy Impact

The Flow: A private foundation (under IRC §501(c)(3)) lets you give back, reducing taxable estate value while cementing your legacy. It’s a philanthropic stream, guided by IRS rules on distributions.

Why It Works: A $2 million foundation donation cuts estate tax exposure by $800,000 (40%), offering tax deductions and social good.

The Catch: Requires annual 5% payout (IRC §4942); setup and compliance cost $10,000+. Oversight is strict (e.g., IRS audits for misuse).

Best For: Philanthropic goals, excess wealth - leaving a lasting mark.

The Strategic Insight: A Symphony, Not a Solo

TOD flows for liquidity, dodging probate costs (e.g., $5,000–$20,000 in Texas) on a $1 million brokerage account. Revocable trusts shape homes if funded, skipping probate fees (e.g., up to $200,000 in New York).

Irrevocable trusts shield big assets from $800,000 tax hits, while foundations redirect wealth tax-efficiently. The Tax Iceberg™ Concept warns: misalign or defer, and taxes sink to death-53% ($800,000 federal + $200,000 state + probate costs) if near $7 million.

The Mini Family Office: 2–4 yearly meetings, 1–2 advisor calls - harmonizes this, trimming the iceberg with gifting (IRC §2503) or trusts (§2056).

Be Water: Adapt Like a Pro, Incorporate the Mini Family Office Model To Be Flexible, Like Water

Bruce Lee didn’t stick to one move; he flowed. Paul Newman’s Newman’s Own turned profits into tax-smart giving with adaptability. You can too:

Anticipate the Tide: Test the government’s view with a $7 million scenario.

Flow with Tools: TOD for cash and stocks, revocable trusts for homes, irrevocable trusts for investments, foundations for legacy.

Align the Current: The Mini Family Office syncs advisors, keeping your plan liquid.

Without this, a $2 million in excess of the gift tax limit on an estate could drown in $1.066 million of taxes.

Action Plan: Shape Your Legacy

Don’t let rigidity sink you.

Take a second to get a complete and comprehensive Estate and Tax Evaluation and Assessment to understand what's at stake. Don't leave your wealth to the court to decide - because if you're not going to do it, they will.

Fill the short application and get started here: