⚠️ The Insurance Illusion: Why “Tax-Free” Life Insurance Still Triggers Massive IRS Estate Tax Bills

⚠️ The Insurance Illusion: Why “Tax-Free” Life Insurance Still Triggers Massive IRS Estate Tax Bills

The truth behind what insurance agents won’t tell you—until it’s too late

👋 Hi, Sidhartha here.

I’m a philosopher, truth seeker, lawyer, and AI innovator.

Over the last 25 years, I’ve made bad decisions in almost every category - business, tax, estate planning, nonprofits, and real estate.

But one of the most painful?

📉 I bought the wrong insurance policies.

I trusted polished advisors and confident salespeople.

And I lost a lot of money - to scammers and poorly trained insurance agents who didn’t understand the tax code, didn’t understand the law, and didn’t care what would happen after I died.

Now, this is my mission.

To expose the myths.

To share the real tax law.

And to protect others from making the same irreversible mistakes.

🤯 THE MYTH: “Life Insurance Is Tax-Free”

👨⚖️ IRAC Framework:

IRAC stands for Issue, Rule, Analysis, and Conclusion—a structured legal method used to break down complex questions and explain how the law applies in real-world situations.

🔹 Issue:

Is life insurance actually tax-free when it comes to estate planning, or can the IRS include it in the taxable estate and apply up to 40% tax?

🔹 Rule:

IRC §101(a) – Life insurance death benefits are excluded from income tax for beneficiaries.

IRC §2042 – If the decedent retains any incidents of ownership in the policy at death, the full death benefit is included in the gross estate.

IRC §2035 – Any transfer of a policy within 3 years of death is pulled back into the estate, even if the policy was gifted or assigned to a trust.

IRC §§2501–2522 – Transferring a policy to a trust or person is a gift, potentially triggering gift tax if the value exceeds the annual exclusion and Form 709 is not filed.

State estate/inheritance tax codes – States like PA, NY, OR, MD, and CT may tax insurance proceeds if included in the gross estate or if the beneficiary is not exempt.

🔹 Analysis:

Most people understand that life insurance is income tax-free - but that’s only part of the picture.

The deeper trap lies in ownership and control.

If the insured owns the policy at death- or had the power to change beneficiaries, take loans, or surrender it - it is considered part of the estate.

Retained ownership = estate inclusion = up to 40% federal estate tax

Add in state estate or inheritance taxes, and the true tax can approach 50%+ of the policy.

Even worse, many people attempt to transfer the policy to a trust (like an ILIT) but do so within 3 years of death.

Under IRC §2035, the IRS ignores the transfer. The policy gets dragged right back in.

Trusts themselves often fail:

Not properly funded

No Crummey letters issued

Retained incidents of ownership

Beneficiaries never notified

No gift tax returns filed

Here are two cases that provide guidance on the law:

📚 Estate of Skifter v. Commissioner, 468 F.2d 699 (2d Cir. 1972):

A failed assignment and retained control caused the IRS to include the full policy in the estate.

📚 Estate of Ledbetter v. Commissioner, 109 T.C. 408 (1997):

Trust formalities ignored. IRS won. Full insurance payout taxed.

🔹 Conclusion:

While life insurance is income tax-free, it is not estate-tax-free unless:

You relinquish all control

You fund it through an independent ILIT

You follow trust formalities

You plan at least 3 years before death

The myth of “tax-free insurance” leads to massive unexpected tax bills, broken trust plans, and confused families who thought everything was protected.

🔍 BENT Law™ Analysis

B – Behavior

If you pay the premiums, change beneficiaries, or borrow from the policy—you have “incidents of ownership” under §2042. This pulls the policy into your estate.

E – Entity

Revocable trusts don’t protect you. The only structure that works is a well-funded, irrevocable trust, with independent trustees and proper documentation.

N – Numbers

A $5M death benefit added to a $10M estate = $15M total.

Exemption in 2026 may drop to ~$7M.

That means $8M taxable x 40% = $3.2M tax loss — on a “tax-free” policy.

T – Timing

Transfers within 3 years of death don’t count. Late planning = inclusion under §2035.

You can’t wait until you’re sick to fix this. The clock started 3 years ago.

🔬 BENT Asset Risk Lens

Behavior - Retained power to make changes = ownership = taxed

Entity - Policy held in personal name or revocable trust fails

Numbers - Policy creates unintended tax for family

Timing - Last-minute transfers are reversed by the IRS

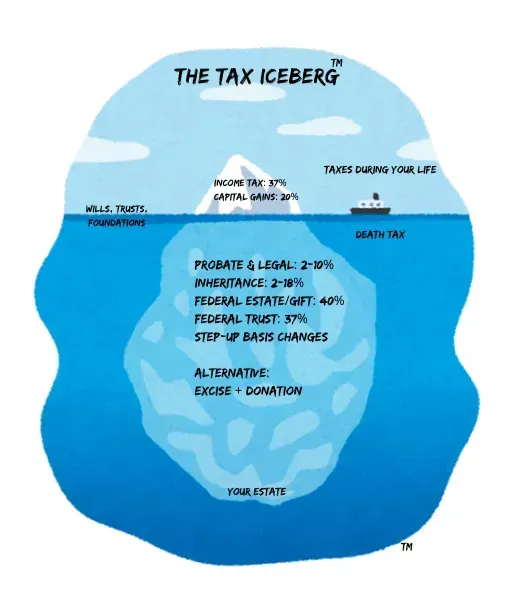

🧊 Iceberg Summary

Above the Surface:

“My policy is tax-free.”

Below the Surface:

✔ Only income tax is excluded

✔ Estate tax still applies if you have control

✔ Retained ownership = §2042 inclusion

✔ 3-year rule = §2035 clawback

✔ Improper ILIT = full death benefit taxed

⚖️ Other Risks: Probate, State Tax, and Gift Traps

Probate Risk:

If your estate is the beneficiary—or if no beneficiary is named—the proceeds are subject to probate, delaying access and increasing court fees.Gift Tax Risk:

Transferring a policy to a trust counts as a gift under §2503.

You must file Form 709 and may eat into your lifetime exemption if the value exceeds the annual exclusion.State Inheritance/Estate Tax:

States like PA, MD, CT, and NY may tax insurance proceeds regardless of federal treatment, especially when beneficiaries are not immediate family.

✅ Suggested Next Step

🎯 BENT Law™ Insurance & Estate Tax Review – $1,000

We go beyond what your agent or planner told you.

Includes:

✅ Ownership audit & control exposure

✅ Trust & ILIT structure compliance check

✅ §2035 3-year clawback and incident-of-ownership review

✅ Estate tax and gift tax calculation

✅ Report with IRC codes, risk areas, and steps to fix

✅ Real recommendations - no sales pitch

There's a good chance we don't even offer the type of services you'll need to patch gaps or fix leaks, but that's what we can help you figure out and find the experts to help you. We're a combination of lawyers, detectives, and investigators who are here to protect your family.

🧠 Don’t wait until it’s too late.

I did. And it cost me.

Now I’m here to make sure that doesn’t happen to you.