Myth about wills

👋 Hi, Sidhartha here.

I'm a philosopher, truth seeker, researcher, lawyer, and AI innovator.

Over the last 25 years, I’ve made my share of bad decisions — across business, investments, tax, estate planning, nonprofits, real estate — you name it.

I’ve lived through:

Bankruptcies

Pierced entities

Seized and liquidated assets

The auction of my grandfather’s estate

Family drama that tore relationships apart

Clients who went from testimonials to being watched by the IRS, FBI, DOJ, FTC

I’ve studied law in three countries, worked with over 10,000 people, and helped restructure over $5 billion in assets. And now, with AI at our side, we can scale this impact 100,000x — because the scammers are getting smarter, and the public is being misled at scale.

🎯 My mission is simple:

To debunk the myths — using facts, cases, and codes — so you can make decisions based on the truth, not marketing hype.

This is how we protect our families, our clients, and our future.

Let’s start with one of the biggest myths in estate planning:

🧊 The Myth:

“I have a will, so my family will avoid probate.”

🔍 The Reality:

A will doesn’t avoid probate. It requires it.

⚖️ The Rules:

A will is a legal document meant for the probate court to interpret and validate. That’s its job. By law, a will must pass through court supervision to be executed.

Key Legal Codes:

IRC §2033 – Assets controlled by the decedent are included in the taxable estate, including probate property.

California Probate Code §10810 – Statutory probate fees are based on gross estate value, not equity.

Texas Estates Code §256.001 – Wills must be filed in probate court within four years of death.

UPC §3-102 – Probate is required even if the decedent had a will.

📚 Real-World Case Examples:

🟣 Prince (Minnesota)

Prince died without a will or trust. His $156M estate spent over 6 years in probate, with legal fees, tax disputes, and contested heirship claims.

But even if Prince had a will, it still would have gone through probate — just with different arguments.

🟣 Aretha Franklin (Michigan)

Two handwritten wills were found in her couch. Both ended up in probate court. Years of litigation followed. The court was left to decide her intentions — not her family.

🧠 BENT Law™ Analysis

B – Business:

Privately owned business assets become frozen during probate. No one can sign checks, contracts, or file taxes until the court grants access.

E – Estate:

Probate is public, slow, and expensive. All assets and heirs become part of the public record. The risk of fraud, theft, and conflict increases.

N – Nonprofit:

Wills don’t create charitable trusts or family legacy vehicles. Philanthropic intent is often lost, delayed, or contested.

T – Tax:

Probate assets are fully includable in the taxable estate. No tax reduction strategies are built into a basic will.

🔬 BENT Asset Risk Lens™

B – Behavior:

Most people believe a will is enough because they’ve been told that by marketers, not legal strategists.

E – Entity:

Assets are held in your personal name. That guarantees probate, by law.

N – Numbers:

Probate costs average 4–8% of the estate. On a $2M estate, that’s $80K–$160K gone before your family sees a dime.

T – Timing:

Probate lasts 12–36 months, depending on state, complexity, and conflict. During that time, nothing can move forward.

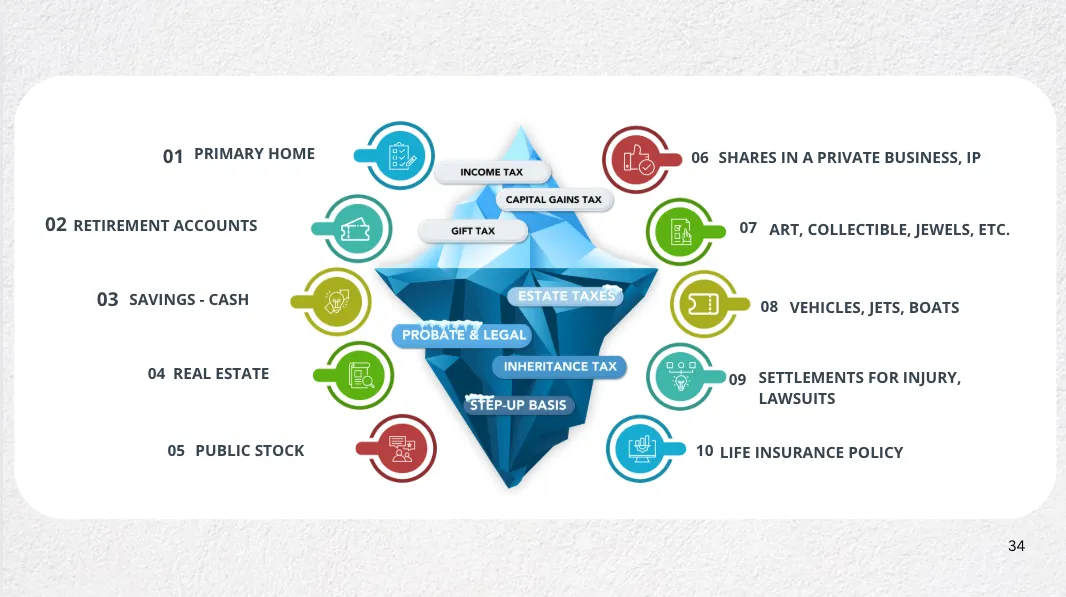

🧊 Above the Surface

“I have a will. Everything’s handled.”

🌊 Below the Surface

Your family must go to court

Assets are frozen for up to 3 years

Attorney and executor fees devour 5–10%

All details become public

No protection from creditors, lawsuits, or tax

🧾 Additional Reference Material

IRC §2033 – Gross Estate Inclusion

California Probate Fee Law – §10810

Texas Estates Code §256.001

Case Study: In re Estate of Prince Rogers Nelson

Case Study: Estate of Aretha Franklin

✅ Your Next Step: Know What’s Really at Stake

Most estate plans are marketed to look solid.

But the IRS and the courts don’t care about brochures — they care about ownership, control, and compliance.

That’s why we built a comprehensive, AI-powered:

🎯 Estate & Tax Risk Assessment – $1,000

You'll receive:

✅ A custom report with citations, legal codes, and case law

✅ A complete asset exposure scan — probate, tax, risk

✅ A step-by-step fix-it plan if needed

✅ Honest clarity: If your plan is solid, we’ll confirm it. If it’s not, we’ll show you exactly where the leaks are

If needed, we’ll connect you with licensed professionals in your state from our vetted referral network — or you can move forward with us directly if we offer what you need.

👉 Reserve your assessment: $1,000

(Coming soon: Dedicated purchase and scheduling page)